If you find yourself relying on your overdraft regularly, you are not alone but it’s important to remember that it is a form of debt and you are being charged overdraft fees for the privilege of using it. Average interest rates increased from £2 per month in 2008 to £12 by 2013 and last year it was reported that banks increased their rates further, some even tripling the previous rate.

If you need help with your finances, Trust Deed Scotland may be able to help. Try the Trust Deed Wizard now to find out more.

There are several steps you can take to see if you could save money on exorbitant overdraft charges:

Set up low balance alerts

Some banks give you the option to receive a free text alert when you are close to going into your overdraft. If you find yourself forgetting to check your balance which results in you going into your overdraft from time to time it may be a good idea to make use of this service to stop you accidentally becoming overdrawn.

See our testimonials for hundreds of independently verified reviews showing how we’ve helped customers get their finances back on track by entering Trust Deeds.

Check if your overdraft is charged monthly or daily

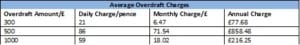

You may only get charged for the days you use your overdraft, so if you had a negative balance for a few days while waiting to be paid, you would only pay a fee for these days. You may, however, be charged monthly. This means that you would be billed at a flat rate for the month, whether you used the overdraft for just a few days or the entire month.

There are simple steps you can take to get your finances straightened out

Move direct debit dates

If you find yourself running short of cash around the same time each month and you have a direct debit due around that time, contact the company and see if you can change the date the direct debit date. This could be the difference between needing to dip into your overdraft or staying in credit.

There is a lot of conflicting information available about your finances. We have dispelled common myths about bad credit to help you make an informed decision.

Change your current account to one with lower interest fees

Look around at the options available to you. Your current bank may offer an account with more attractive overdraft rates or perhaps changing to another bank is your best option. Some accounts have a monthly usage charge but include no or low interest overdrafts in the cost. Depending on how much your overdraft is costing you at the moment and if you use it regularly, you may you save money by going for this type of account.

To find out more see our Scottish Debt Help page or Contact Trust Deed Scotland for more information.