Over 3,500,000 people in the UK now have council tax arrears debt, with an average of £800 council tax arrears, reports Citizens Advice*

Founded in 1939, Citizens Advice is a network of 316 independent charities throughout the UK guided by four principles: A free service, Confidentiality, Impartiality and Independence.

The unavoidable debt report published by Benedict Guindi and Tilly Cook of Citizens Advice said that the pandemic and the restrictions put in place to control it, have had a dramatic impact on household finances with many people have been made redundant, furloughed, become too ill to work or have taken time off to care for a loved one.

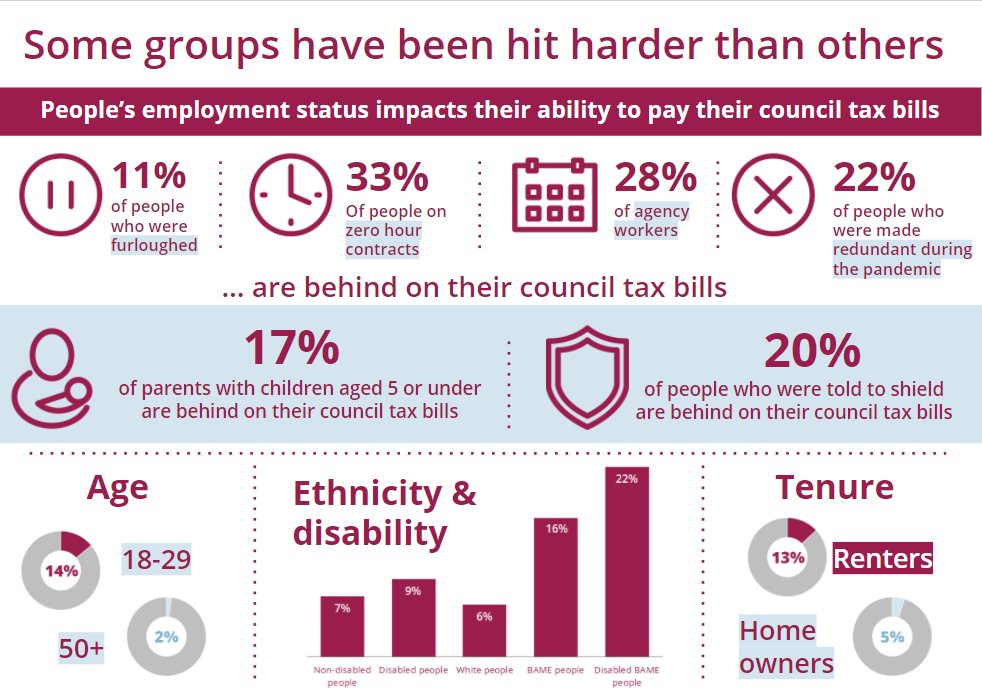

Some groups identified as being most affected by council tax arrears included:

- 11% of people who were furloughed

- 33% of people on zero-hour contracts

- 28% of agency workers

- 22% of people who were made redundant during the pandemic

- 16% of people of BAME

- 22% of people of BAME and with a disability.

- 17% of parents with children aged 5 or under are behind with council tax arrears debt

- 20% of people who were told to shield are behind with council tax arrears debt.

- 14% of people aged 18-29 are behind on their council tax

- 13% of renters and 5% of homeowners indicated that they had accumulated council tax arrears debt.

As a result of the findings of their data, Citizens Advice said:

“On average, the people we help with council tax debt have just £20 left after covering essential living costs to pay off debts. 40% have a negative budget, meaning their income doesn’t cover their living costs.

People are often forced to make trade offs between repaying their debts and covering essential living costs. During the pandemic, 17% of people with council tax arrears were unable to afford food in comparison to 3% of the total population.”

“Councils should prioritise writing off the debts of those who are struggling the most financially, such as those in receipt of Local Council Tax Support and people receiving benefits.

There were existing problems with the way council tax is collected before the pandemic hit. The way the regulations are designed makes it harder for people with council tax arrears to arrange and make repayments.

The Ministry for Housing, Communities and Local Government should use secondary legislation to amend the Council Tax (Administration and Enforcement) regulations to:

- Stop people being liable for their entire annual bill if they miss 1 monthly payment.

- Make it easier for councils to improve collection by giving them more powers to collect debt in a fair way without getting a liability order first.

- Set out more steps councils must take before using the court process.

This would ensure that all people in debt are given the option of affordable repayments to get back on track.”

Council Tax Arrears Debt in Scotland

As reported in the Glasgow Herald in early January, Citizens Advice Scotland warned of a potential Council Tax explosion, with CAS financial health spokesman Myles Fitt saying: “Scotland is potentially facing an explosion of council tax debt in 2021.

The figures before the pandemic are bad enough, but the real fear is that Covid-19 is going to make matters much worse.

Councils across Scotland showed a real empathetic approach to those who found themselves in council tax payment difficulties, and the payment breaks in the first six months of the pandemic were extremely welcome.

However, this has led to arrears building up, arrears that will be difficult to meet for the many people who have during that period experienced an income drop due to unemployment or reduced working hours.

“For others, this problem is yet to come in 2021 when the economic squeeze on personal finances is felt as the furlough scheme and payment support measures close at the end of April, ironically in the same month the first payments of council tax in the new financial year are due.”

CAS is calling on people to make use of the Scottish Government’s council tax reduction scheme which can help reduce future payments. For some people, it can also offer a backdate of up to six months. Contact your local authority for more information. All local authorities should have information on their website including:

Glasgow council

Edinburgh council

Aberdeen city council

North Lanarkshire council

South Lanarkshire council

Highland council

East Ayrshire council

North Ayrshire council

South Ayrshire council

Trust Deed Scotland® said “Falling behind on priority debts such as council tax can have the severest of consequences.

Council tax arrears enforcement action can escalate quickly when there is non-payment of council tax with Sheriff Officers being used to collect outstanding council tax arrears debt with enforcement action such as wage arrestments being used as a last resort to collect outstanding monies.

We’re thankful that Citizens Advice have highlighted these groups that they have identified as being most at risk of developing problems with their council tax and we offer tailored debt advice to anyone who is struggling with unaffordable debts, whether they have council tax arrears debt or other types of unsecured debts such as credit cards and loans.

As well as being able to provide formal, statutory solutions such as Protected Trust Deeds and the Debt Arrangement Scheme, we can also provide some breathing space for our clients who need more time to think about the best solution for their problem debt by using a Statutory Moratorium.”

Help with unaffordable debt in Scotland

To find out more about managing your money and getting free advice, visit Money Helper, an independent service set up to help people manage their money.

Citizens Advice Scotland (0800 028 1456) can give you free, impartial debt advice alongside other money charities including National Debtline (0808 808 4000).

As well as formal debt solutions, The Trust Deed Scotland® team offer debt advice that is…

Non-Judgemental – Our friendly, helpful team want to help find a solution that suits your needs.

Confidential – We do not share your details with any other companies. Your data is safe and secure.

Experienced – 30,000 people helped and over 11,000 five-star reviews on Trustpilot.

Tailored – Advantages and disadvantages of all formal solutions explained.

You can find out more about how we can help you by using our Trust Deed Wizard, or by calling us on 0141 221 0999.

Our experienced debt advisers provide tailored debt advice outlining the pros and cons of the Debt Arrangement Scheme and other formal Scottish debt solutions including Protected Trust Deeds and Sequestration.

*Citizens Advice commissioned ICM unlimited to conduct a survey of a representative sample of 6,004 adults living in the UK. The survey took place between 12th and 25th November. The sample has been weighted by age, gender, region, social grade, work status and ethnicity to be representative of the UK adult population. The 3.5 million in arrears figure is based of 7% of the population being behind on their council tax bills. Then extrapolating this out to the UK adult population of 52.5 million