The two are completely different, but we still see that it confuses people what the difference is when they’re searching on Google! As a result, below you will find the difference between a Trust Deed and a deed of trust to help you on your way to finding more about what you need.

What is a Trust Deed?

If you’re struggling financially and require debt advice in Scotland or support on how to move ahead, an advisor may make you aware of the opportunity of entering into a Trust Deed. Before you do so, you should ensure that you understand what a trust deed is, how it works and be aware of other debt arrangement schemes available.

A Trust Deed is a voluntary agreement between you and your creditors (who you owe money to) to repay what you owe. It’s a government-backed scheme that’s only available to Scottish residents for more than six months, and who have a debt of £5,000 or more.

A Trust Deed can be particularly helpful if you’re struggling to pay your debts within a reasonable timeframe – five years, for example. It’s generally a more straightforward and less restrictive alternative to declaring bankruptcy and can be used to pay off part of any “unsecured debt”, such as money borrowed using credit cards and loans.

It’s important to note that social security benefits and things like Universal Credit can be taken into account to assess your situation when you apply for a trust deed, but the contribution you pay back will not be taken from these funds.

Generally, only disposable income is used to pay creditors, but other assets such as furniture could also be liquidated to help make contributions, but this will have been agreed with your advisor before entering a trust deed.

The financial advice on offer meanwhile when you enter into a trust deed can include remortgaging, but this is not mandatory and typically not advised unless a final option.

There are two types of trust deed – protected and unprotected. An unprotected trust deed is not binding for a creditor (company or other) who doesn’t agree to the terms. A Protected Trust Deed meanwhile is binding for the creditor, although they have a 5 week period in which to appeal.

It’s in the interest of the trustee to have the trust deed protected, but it’s not essential. It is also worth noting that a trust deed debt must be a minimum of £5,000 to become protected.

You should be aware that all protected trust deeds that fall under the court of session and within the territorial jurisdiction of Scotland are advertised as a public record in the AIB register. It is also likely that setting up a trust deed will affect your credit record. Trust deeds can only be administered by a licensed insolvency practitioner.

What is a Deed of Trust?

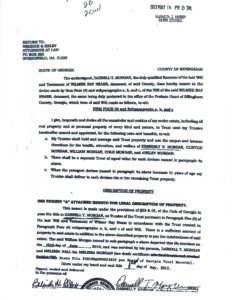

Although similar in name, a deed of trust is something entirely different from a Trust Deed. A deed of trust is an important document (governed by The Trustee Act 2000) in which trustees are appointed to hold the property for beneficiaries.

A Deed of Trust can be used to state how a property is owned.

For example, the property may be owned by several parties, each with a different contribution towards the ownership, and this proportion of ownership may not be listed in the land registry. A deed of trust enables someone to be a protected owner of the property, even if they are not a registered owner with the land registry.

A Deed of Trust can be necessary for various circumstances.

For example, say that someone wishes to contribute towards buying a new house with their partner. However, they are already the owner of a property with a mortgage, so they cannot be part of the mortgage on the new house. A deed of trust can be used to register their contribution towards, and ownership of, the new property, while their partner is listed with the land registry as being the sole owner.

What is a trustee in a Deed of Trust?

A trustee is somebody who manages the property that is held in a deed of trust. Trustees are entrusted to act in an appropriate manner, and always in the interests of the beneficiaries.

What is the difference between a Trust Deed and a Deed of Trust?

So how does a Trust Deed in Scotland differ from a Deed of Trust?

A Trust Deed is an alternative to bankruptcy in Scotland and involves a professional overseeing your repayment of debt over a certain amount of time to your creditors.

A Deed of Trust meanwhile is a legal document most commonly related to the ownership of property and involves a trustee managing how it is really owned, enabling your percentage of ownership to be protected, even when you are not listed in the land registry as the owner.

To find out more about Trust Deed Scotland and if you qualify for a Trust Deed, try our Trust Deed Debt Calculator.

Debt Help Scotland ✓ 30,000 people helped ✓ No.1 Rated ✓ Tailored Advice ✓ No Setup Fees.